Despite years of increased interest, a recent article in the Wall Street Journal stated that Chinese investors are now losing interest in the American real estate market. For years, China’s growing middle class has looked to American real estate as a safe investment. Recently, however, demand for property has started to taper off. During the Recession, American real estate was seen as a bargain by many Chinese families who were leary of the stock market and other investment vehicles. Traditionally, real estate has been considered a good investment in China. Many traditional families hold the belief that it is a way to invest their money that is not dependent on economic factors beyond their control. American real estate provided them a way to sidestep Chinese government regulations about what they could own in their homeland, while placing this r money and assets in a country with a stable economy and government. Owning property in America was also seen as an entryway to gaining citizenship. Recently, however, this investment has seemed to lose some of its luster. Higher prices in many American cities that were popular among foreign investors have made it more expensive for Chinese nationals to add American property to their portfolio. Properties that were considered a bargain during the Recession are now seen as overpriced by many financial advisors. For investors, this means that there are fewer “good” properties to put their money into. Increased regulation of foreign investment in the wake of recent terror attacks has also made it more difficult to transfer money to and from the United States. To combat this, many realtors are encouraging their Chinese clients to look in areas outside of major metropolitan areas. As the real estate market normalizes in price, buyers are expected to return.

Debbies’ Tip’s – The Holidays Do Not Begin On Halloween.

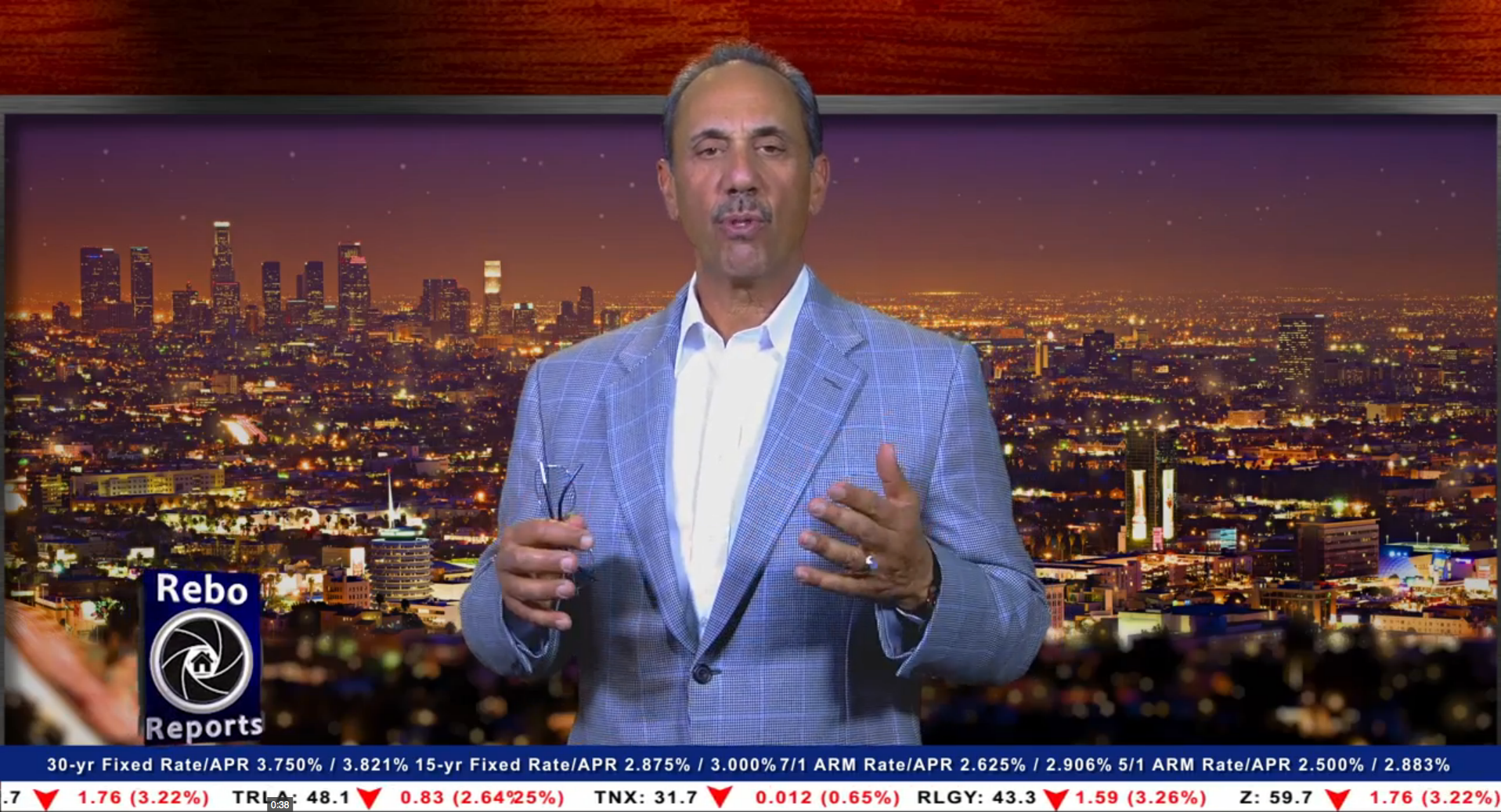

I welcome to ReboReports and this is Debbie's weekly tip. Okay so here's the big one for ...

Learn more